10 Simple Ways to Stick to Your Budget and Make Every Dollar Count

Tips for Saving Money and Sticking to a Budget

Saving money and following a budget are key to managing your finances well.

When you make a budget and stick to it, you can save more, spend smarter, invest better, and take charge of your money. Whether you're trying to pay off debt, save for something special, or make your money go further, these 10 tips will help you stay on track and make the most of every dollar.

Let’s dive in!

Free 3-Step Blueprint

3 Simple Steps to Start Earning Online

Learn how everyday people turn simple free content into real daily income using a proven 3-step affiliate blueprint.

🔒 Get the Free $600/Day Blueprint ➜Disclosure: At no cost to you, I may get commissions for purchases made through links in this post.

1. Know Your Why and Keep It in Mind

Understanding why you’re budgeting is super important.

Whether you’re saving for a home, paying off debt, or planning a dream vacation, having a clear goal will keep you motivated.

Make sure to revisit your reason often to remind yourself why sticking to your budget matters. This simple mindset trick will help you stay on track, even when spending temptations pop up.

Related reading: Top 4 Best GPT Websites and Apps to Earn Money Online

2. Spend Only on What You Truly Value

Identify what really matters to you and direct your money toward those things.

If experiences bring you more joy than material possessions, prioritize spending on them. This way, your spending reflects your values and brings you satisfaction, making it easier to stick to your budget.

By focusing on what truly enriches your life, you’ll avoid wasting money on things that don’t bring you happiness.

3. Set Meaningful but Realistic Spending Goals

Creating achievable goals is essential for successful budgeting.

Unrealistic targets can lead to frustration and make you lose interest. Instead, focus on small, attainable goals that help you reach your larger financial objectives.

For example, if you want to save $100 each month, break it down into manageable weekly savings targets. This makes the process less overwhelming and much easier to stick with.

Need Easy & Extra $600/Mo For Free?

Survey Junkie: Earn up to $50 per survey & $1.50 per referral. Signup here!

Myfreeapp: Get paid to play games and explore new apps.. Signup here!

⭐️ Important:Don’t forget to verify your email after signing up for Survey Junkie, Swagbucks, Myfreeapp, Scrambly and Freecash to unlock your bonuses and start earning instantly!

4. Choose Friends with Similar Values

Surround yourself with people who understand and respect your financial goals.

Friends who share similar values won’t pressure you to spend unnecessarily. Instead, they will support your budgeting efforts and might even share helpful tips.

Being in a supportive environment makes it easier to stick to your budget and keeps you focused on your financial plan.

5. Create a Designated Space for Budgeting and Financial Planning

Having a specific place to manage your finances can make budgeting more efficient and effective.

Whether it’s a home office or a quiet corner, choose a space that’s free from distractions. Use this area to review your expenses, set goals, and reflect on your financial progress.

A dedicated space helps you stay focused and makes budgeting a regular, important part of your routine.

Okay, we’re halfway through today’s money tips! Before you continue, don’t forget to save thisPIN!

6. Pay Yourself First

Make saving a priority by treating it as a must-have expense, just like your rent or mortgage.

Set aside a portion of your income for savings before you spend on anything else. This way, you consistently put money aside for future needs or emergencies.

Most importantly, this habit reinforces the importance of budgeting and helps you prioritize your financial health.

Much Read – 9 Easy Money Tips for Fast Investing Growth

🚀 Want to Earn While You Learn?

Join 7,000+ readers who use this free 3-step blueprint to turn online learning into predictable income.

7. Always Track Your Spending

Monitoring where your money goes is crucial for effective budgeting.

Use an app, spreadsheet, or notebook to log your expenses and assign them to your budget categories. This practice keeps you aware of your spending habits and helps you spot areas where you can cut back.

By consistently tracking your spending, you can make informed decisions, adjust your budget, and allocate money to what you truly value.

8. Be Patient with Yourself, But Stop Making Excuses

Budgeting is a journey that takes patience, dedication, and persistence.

It’s normal to make mistakes or occasionally stray from your plan. However, don’t let challenges derail your efforts.

Learn from your setbacks and keep pushing forward. At the same time, avoid making excuses for overspending or not saving. Hold yourself accountable and stay committed to your financial goals.

9. Be Grateful for What You Have

Practicing gratitude can change your mindset and make budgeting feel less restrictive. When you appreciate what you have, you’re less likely to feel deprived or tempted to overspend.

Gratitude helps you focus on the positive aspects of your life and reinforces the importance of managing your finances wisely. This positive mindset can make it easier and more fulfilling to stick to your budget.

10. Monitor, Reflect, Adapt, and Adjust

Regularly reviewing your budget ensures it stays relevant to your financial plans. Take time to reflect on your progress at least once a month and adjust your budget to accommodate changes in your income or expenses.

Being aware of your circumstances helps you stay on track and make necessary adjustments to meet your goals. By monitoring and adapting, you maintain control over your finances and ensure your money works for you.

Finally, take pride in your achievements. Use your progress as motivation for even greater financial gains.

You might like – 6 Best-Paid Side Hustle Jobs To Work from Home

How to Stick to a Budget – Wrap-Up

Sticking to a budget is about more than just numbers and spreadsheets; it’s about making choices that align with your values and goals.

By incorporating today’s money tips and financial lessons into your routine, you’ll develop good habits and achieve financial stability. While sticking to a budget may take effort, the long-term rewards of financial freedom and peace of mind are well worth it.

Don’t forget to Save This PIN for easy access later!

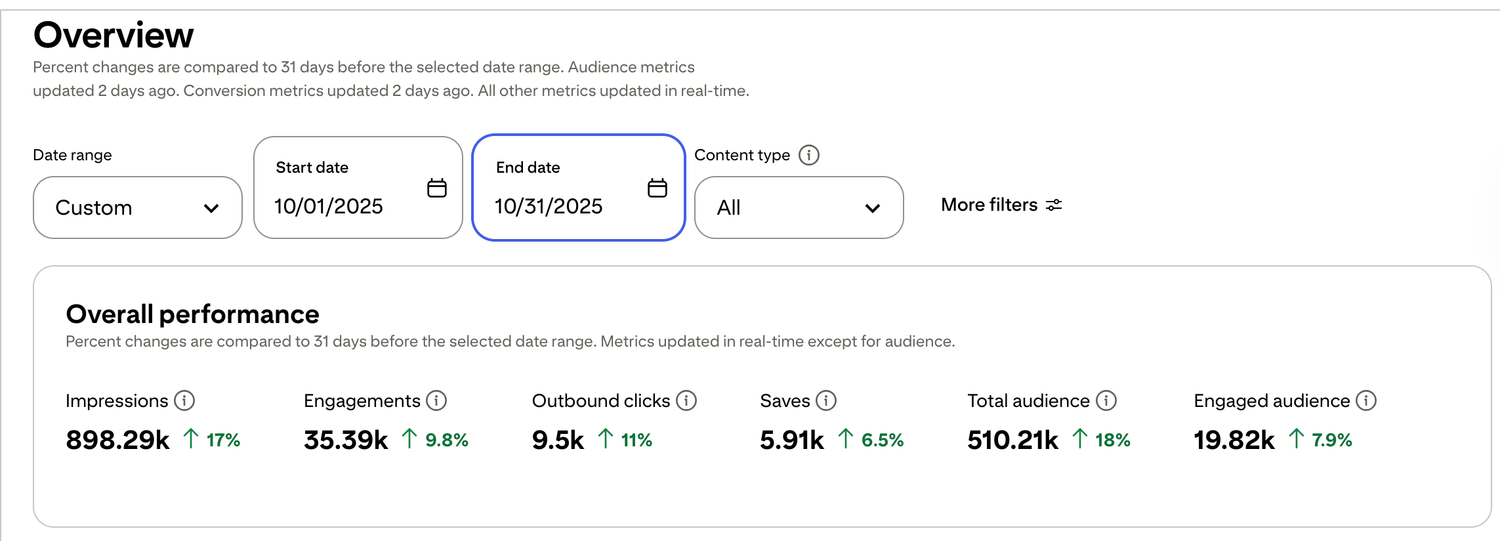

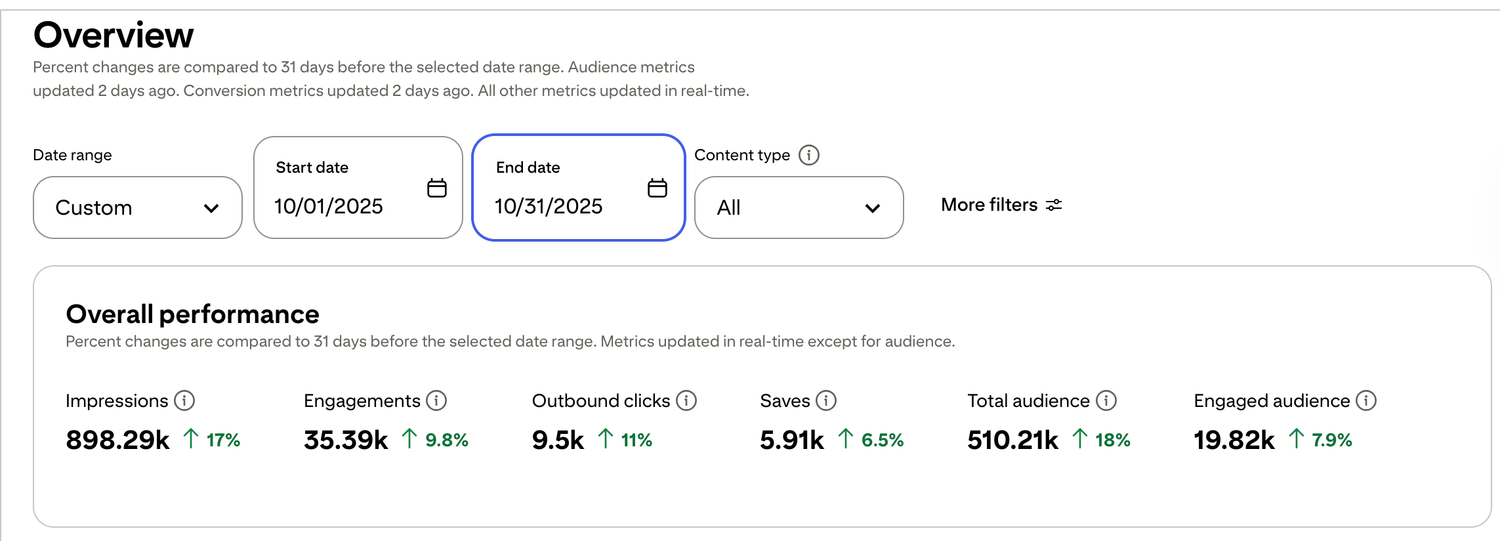

🎯 Real Results from the Blueprint

Transparent Pinterest growth backed by real analytics — the same system you’ll learn inside the free guide.

If this guide gave you a few “lightbulb” moments, you’ll love the full $600/Day Blueprint . It shows exactly how I turn simple free content into predictable daily income — step by step, with zero fluff.

🔥 7,000+ Readers Already Downloaded This Blueprint

🎯 Ready to Turn What You Just Learned into Daily Income?

Download the $600/Day Blueprint Now.

🔒 100% Secure • No Spam • 1-Click Unsubscribe

A blog offering practical tips on making money online, affiliate marketing, investing, and work-from-home jobs.

Solutions & Tips

How to Make Money Online

Investing for Beginners

Money Saving Tips