9 Easy Money Tips for Fast Investing Growth

The basics of smart investing never change. I reached financial freedom through wise investments, and now I want to share my best tips with you.

These tips have helped me and many others make solid long-term gains. Stick with me until the end, and I'll show you how these simple investing tips can turn a small amount of money into a lot!

Let’s get started.

Free 3-Step Blueprint

3 Simple Steps to Start Earning Online

Learn how everyday people turn simple free content into real daily income using a proven 3-step affiliate blueprint.

🔒 Get the Free $600/Day Blueprint ➜Disclosure: At no cost to you, I may get commissions for purchases made through links in this post.

9 Easy Investing Tips for Beginners

1. Think Long Term

Don't invest if you're looking to get rich quickly. However, if you're patient, a mix of dividends, rent, and capital gains can give you around a 10% return each year over the long term.

Keep in mind, though, that investments can go down in value, sometimes by a lot, in the short term. For example, I've stayed invested through some tough times like:

The burst of the Internet bubble in 2000

The 2007-2008 financial crisis

The pandemic market collapse in 2020

Having a long-term mindset is key to staying invested during tough times. The most successful investors make the most money when others are panicking.

So, what does long-term mean? I recommend at least five years. For me, it’s been a lifetime of making long-term investments.

You might like: Top 10 High-Paying Work at Home Careers

2. Determine Your Investment Objectives

Understanding why you want to invest is crucial for developing a long-term mindset. You need to be clear about your investment goals.

Here are some possible reasons for investing:

Building long-term wealth

Getting involved in the stock market

Achieving financial freedom early

Earning extra income through dividends

Planning for retirement

So, what's your reason for starting to invest?

3. Adopt An Investing Strategy

Understanding your investment goals helps you choose the right strategy, as not all strategies are the same.

Here’s how I categorize investment strategies:

Conservative Investors: Higher income with lower growth potential.

Aggressive Investors: Higher growth with lower income.

Balanced Investors: A mix of growth and income.

Need Easy & Extra $600/Mo For Free?

Survey Junkie: Earn up to $50 per survey & $1.50 per referral. Signup here!

Myfreeapp: Get paid to play games and explore new apps.. Signup here!

⭐️ Important:Don’t forget to verify your email after signing up for Survey Junkie, Swagbucks, Myfreeapp, Scrambly and Freecash to unlock your bonuses and start earning instantly!

4. Choose Your Investments Wisely

Having a clear strategy makes choosing investments easier. Here’s a simple guide:

Conservative Investors: Look at certificates of deposit, money market funds, and bonds.

Aggressive Investors: Focus on stocks.

Balanced Investors: Consider adding real estate, like your home or rental properties, to your portfolio.

For stock investing, you can simplify it with index funds, exchange-traded funds (ETFs), or mutual funds. Personally, I prefer dividend stocks for their balance of growth and income.

For serious real estate investors, I highly recommend this amazing tool to help you discover great deals in the market.

5. Invest Regularly

From investing tip #1, we know that a long-term view is crucial. But short-term habits are also important.

Specifically, invest money regularly. I use dollar-cost averaging, which means I invest a set amount of money in stocks each month. This helps me stay on track with my goal of monthly investments.

We’re halfway through! Keep going, and don’t forget to save this Pinterest PIN to come back to this post later.

6. Diversify Your Investment Portfolio

I often get asked: What’s the best number of investments to own?

My answer is: Have enough investments to ensure good diversification, but not so many that you can’t manage them effectively.

The right number of investments varies for each person. For instance, one stock market ETF and one rental property might offer enough diversification for some investors.

If you’re investing in individual stocks, a good rule of thumb is to hold between 20 and 30 high-quality companies.

One mistake I made as a young investor was holding too many stocks. I ended up with more companies than I could effectively monitor. Plus, many of my stock positions were too small to make a significant impact on my returns.

Related reading – 10 Best Ways to Save Money on a Low Income

🚀 Want to Earn While You Learn?

Join 7,000+ readers who use this free 3-step blueprint to turn online learning into predictable income.

7. Use Consistent Selling Criteria

How do you decide when to sell an investment?

Ideally, you want to buy investments and hold them long-term. However, even the best investors need to sell sometimes.

I mainly sell investments that no longer align with my strategy. For instance, as I’ve aged, I’ve shifted from aggressive to more conservative investments.

Having clear investment goals and a solid strategy makes it easier to decide when to sell.

8. Learn As Much As You Can

The more you learn about investing, the better you’ll become. So, keep educating yourself as much as possible.

Be smart: know what you’re doing and understand where your money is going.

9. Consider Alternative Investments

Putting all your money into one type of investment is rarely a smart move. As you gain more investing experience, think about adding different asset classes to balance out the ups and downs of individual investments.

Alternative investments, like commodities, land, cryptocurrencies, or precious metals, can be a good addition based on your age and financial situation.

For investors like us, even small amounts of money can make a big difference. For instance, if you save and invest just $50 a month with a 10% annual return, you'll have around $5,000 in about six years.

On the other hand, if you choose not to invest, you might end up with nothing.

The choice is yours. Personally, I prefer to invest regularly.

That’s it for now. Let me share some final thoughts.

Good investors stay disciplined. They know the fundamentals of investing and apply these tips consistently.

You might like – 10 Simple Ways to Stick to Your Budget and Make Every Dollar Count

Here are the 9 investing tips for beginners:

1.Think long term

2.Determine your objectives

3.Adopt an investing strategy

4.Choose investments wisely

5.Invest regularly

6.Diversify your investments

7.Use consistent selling criteria

8.Learn as much as you can

9.Consider alternative investments

Save this PIN to your favorite Pinterest board

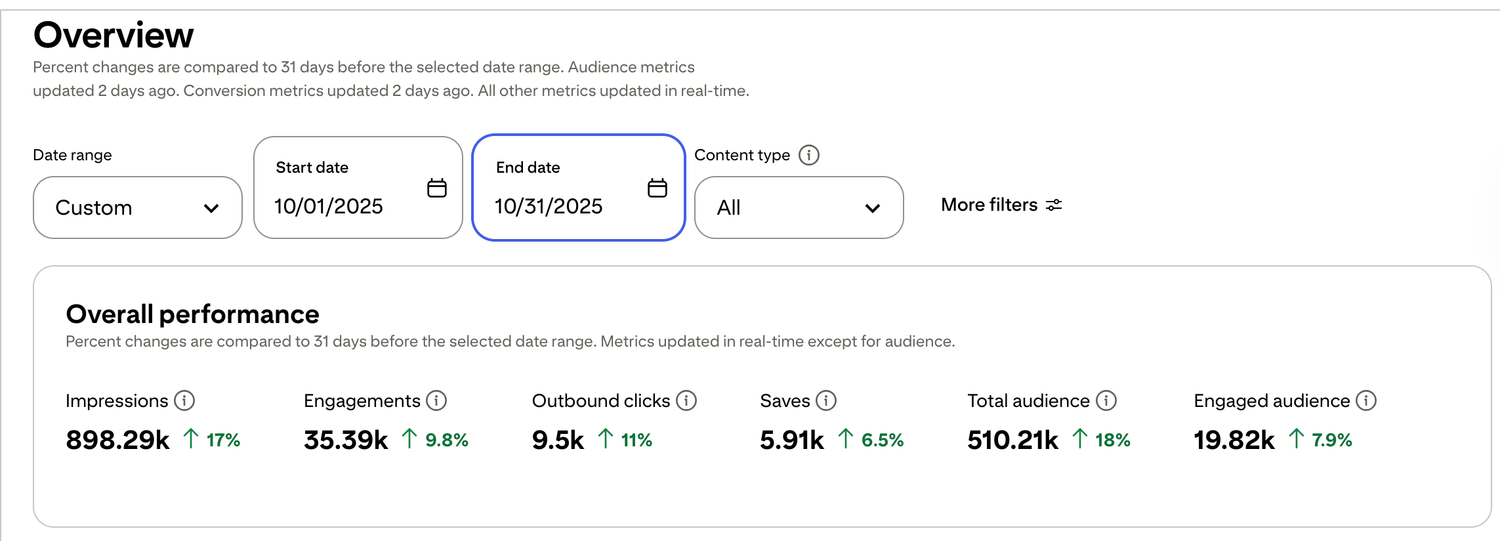

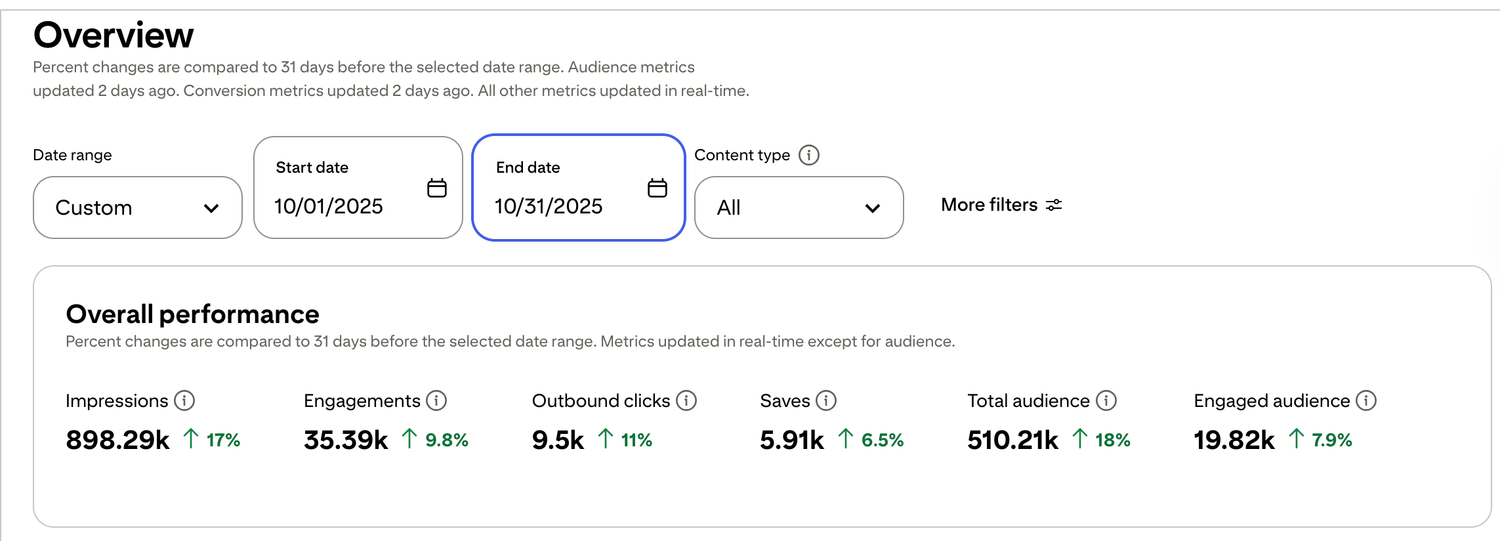

🎯 Real Results from the Blueprint

Transparent Pinterest growth backed by real analytics — the same system you’ll learn inside the free guide.

If this guide gave you a few “lightbulb” moments, you’ll love the full $600/Day Blueprint . It simply shows how I turn free content, days like this, into predictable daily income — step by step, with zero fluff.

⏰ 7,000+ Already Joined

Copy the 3-Step $600/Day System

✔️ Takes less than 30 seconds

✔️ 100% privacy — no spam ever

🚀 Start building income that works while you rest.

🔒 100% Secure • No Spam • 1-Click Unsubscribe

🔥 7,000+ Readers Already Downloaded This Blueprint

🎯 Ready to Turn What You Just Learned into Daily Income?

Download the $600/Day Blueprint Now.

🔒 100% Secure • No Spam • 1-Click Unsubscribe

A blog offering practical tips on making money online, affiliate marketing, investing, and work-from-home jobs.

Solutions & Tips

How to Make Money Online

Investing for Beginners

Money Saving Tips